Smartphone usage - Myopia - Part 2

Post is originally from my previous blog www.globalstockpicking.com

In the early days of my blog I talked a lot about my investment process, how I tried to combine top-down analysis of long term trends with bottom-up stock picking. I still think the best ideas comes from this approach, you identify something the market has not fully appreciated yet and then you find the best company in that something area and you buy that. Hopefully you both got a discount because the company is trading cheap and you get exposure to an area/theme which in general is trading at a discount because the market has not priced in the outcome you see. As both these things re-price you get a double re-pricing effect, which can be very powerful. In this case this trend is not news, but I think I found a pocket of this trend which is not appreciated how much it will grow. Also unfortunately the company is not cheap on trailing multiples, but it is at an infliction point where growth is pulling up margins quickly, so a few years out it does not look too expensive.

Now that I have been doing this for quite a while, I can start to evaluate my track record also on my top-down analysis. Maybe somewhat surprising I feel have got the long term trends more correct than my actual stock picking. Expressed a different way, even if I figured out where the world is going, betting on the right companies that benefit from that has often been far from easy. So what I have tried to become better at is the stock picking part and not get too excited about the top-down analysis. If no good enough company presents itself at the time, I will keep my world view in mind and keep my eye out for a suitable investment, but I won't force it. For this top-down analysis I have definitely taken my time and it has taken me an incredible 2.5 years to find two investments to express the very long term tailwind I see from the theme of (excessive) smartphone usage. That I found both stocks almost at the same time was partly by coincidence and partly that the growth sell-off has given me opportunities to buy stocks which otherwise were too expensive (not enough margin of safety).

This post is really the part 2 of the investment theme idea started 2.5 years ago, so it's essential to read what I wrote back then first.

http://www.globalstockpicking.com/2020/09/30/smartphone-usage-ticking-time-bomb-part-1/

The Part 1 goes into detail of problems for the neck (cervical spine) I will below expand on the issues related to myopia (not being able to see objects far away). After that I will do two separate posts to present the investments I made in two US companies to benefit on these strong tailwinds. One of the investments I already revealed and invested in ZimVie, which is related to neck issues. The other will be revealed towards the end of this post and is then obviously myopia related. So let's get going on the Myopia background (press to read more)

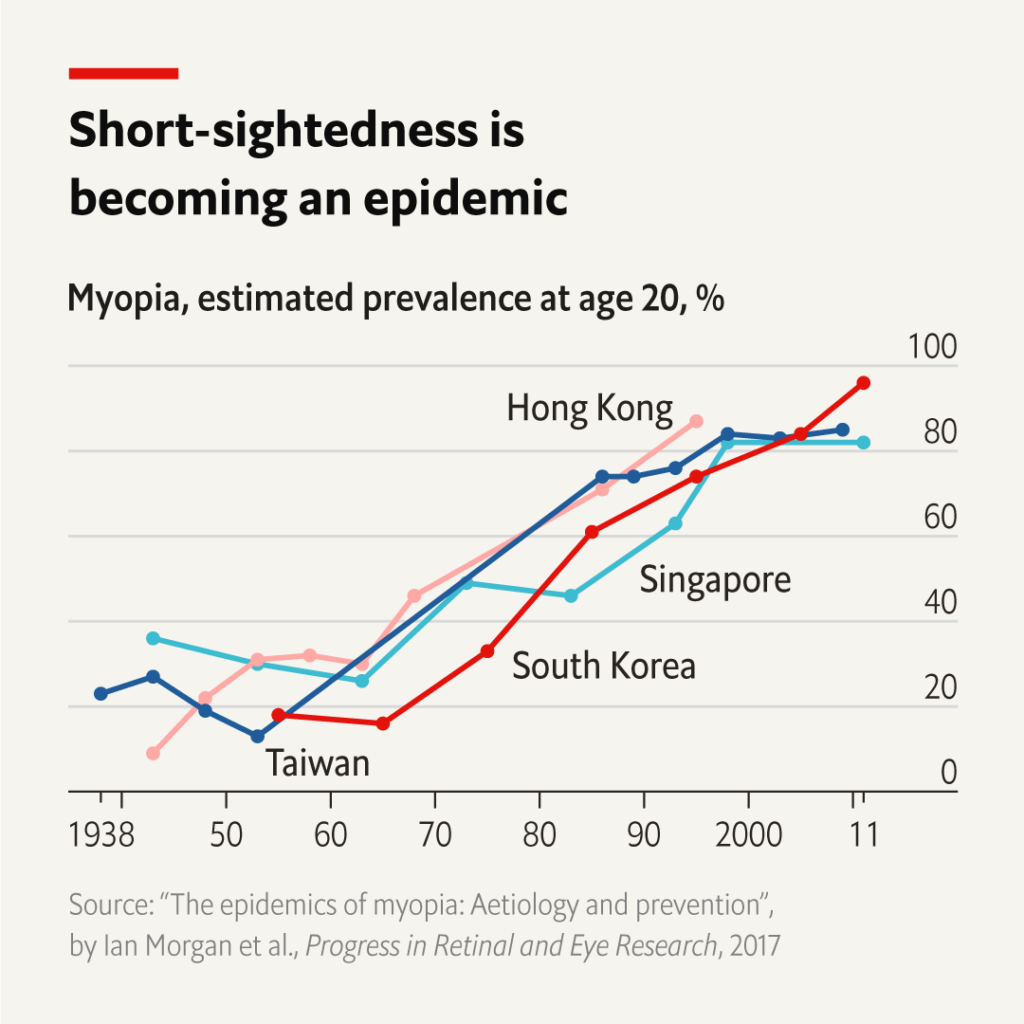

Myopia - an epidemic barely talked about

For decades, researchers had thought myopia (or short-sightedness) was mostly genetic. There were early hints, though, that this could not be the whole story. A study of Inuit in Alaska, published in 1969, found that myopia was virtually unknown in those middle-aged or older, but that rates were above 50% in older children and young adults. Such a change is much too fast to be purely genetic, and it had happened just as the study participants had begun to adopt a westernized way of life. The dominant hypothesis now is that exposure to daylight is the main variable/culprit to myopia. A study of Californian children, published in 2007, found that time spent outdoors was strongly associated with a lower risk of myopia. It explains why rates are high in Asia in particular, since private tutoring and after-school classes mean schoolchildren there routinely work longer days than their Western counterparts. So I'm simplifying this a bit saying it's due to only the smartphone, but the smartphone (or other tablets and gaming devices) are a large reason why kids are not playing outdoors anymore. Below one can see the clear trend of myopia growth world-wide and how it is expected to grow in the future:

World myopia development

Affluent Asian countries were already in the 1990's at the current global levels and looking at the graph of myopia among 20 year old's in Asia that is a hint of where the world is going and why the 2050 figure in the graph above is so extremely high.

Researchers have also been working on ways to slow myopia’s progression once it has started. One is to use low doses of atropine, the juice of which was once used by women to dilate their pupils, in order to make themselves look more attractive. Another is specially designed “ortho-k” contact lenses, which are intended to reshape the cornea while sleeping. Even so Myopia is unfortunately just getting worse, and especially in Asia the numbers are increasing at an alarming rate. In Asia is no longer a question of having myopia, the focus is shifting to how severe your myopia is, because all kids have myopia.

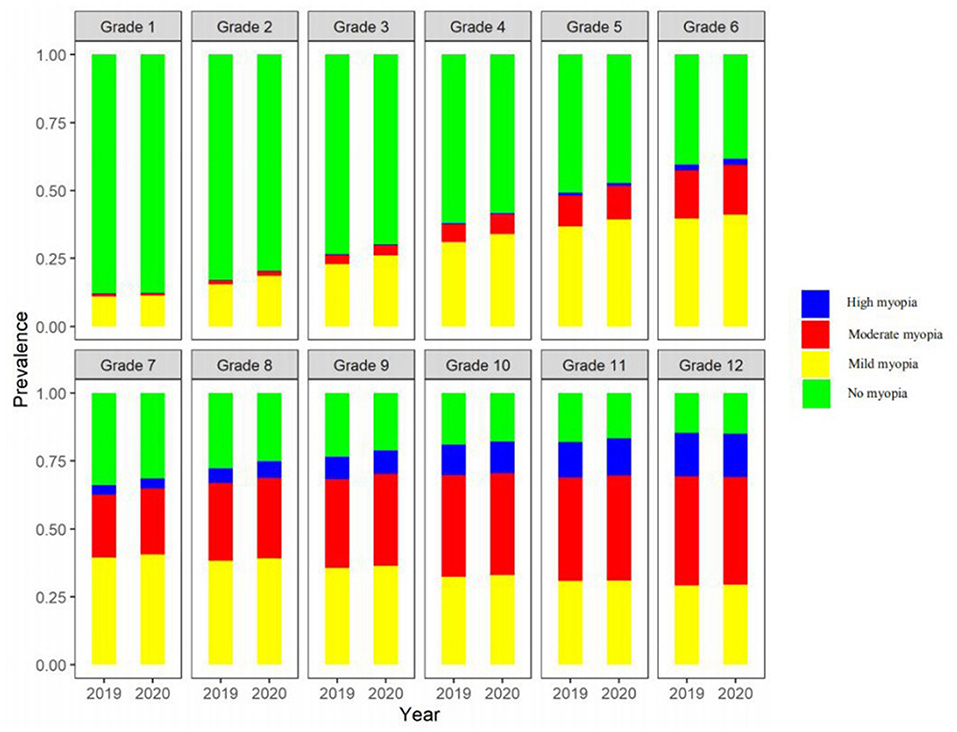

In countries who further locked down their population during Covid or parents trying to protect their children by keeping them indoors, this has just further aggravated an already bad situation, creating even more myopia cases. The conclusion of this recent Chinese study was: "The prevalence of myopia among students increased during the COVID-19 pandemic, especially in primary school Grades 2–5." This latest study suggest Chinese myopia levels are so high now that it's rare for anyone in their early 20s to not have myopia - that is over 250 million people in China alone, all with myopia - mind boggling.

China myopia prevalence in recent study

Source: https://www.frontiersin.org/articles/10.3389/fpubh.2022.859285/full

Diving deeper into Myopia

As can be seen from all the data, kids already have severe myopia and they growing up in the coming 10 years being blind to objects further away, this is a phenomena at a totally new level compared to when you who are reading this probably grew up. To better understand Myopia from an investing perspective one needs to understand what products and procedures for myopia drive revenue for companies. Let's look a bit deeper what is happening under the surface of these myopia figures which seems to almost go towards 100% among children in Asia.

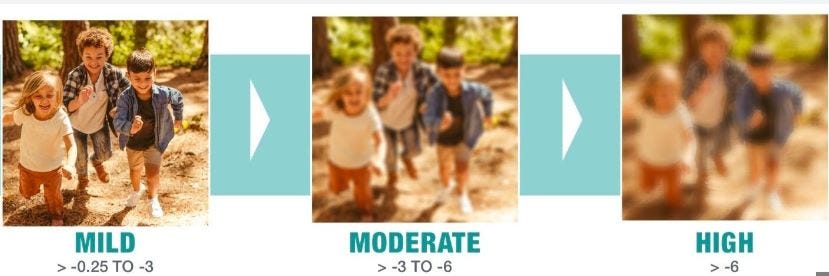

This is what you see if you are in the high moderate or high myopia category (which now majority of Chinese kids are in).

The gold standard solution to permanently solve the myopia problem is LASIK surgery. The picture above basically explains at least to me why so people today do LASIK surgery. What a liberation to go from picture 2 or 3, to picture 1. if you add in the beauty aspects to not need to wear glasses combined with the freedom to actually see clearly again and throw it to not need to spend money on contact lenses in the future, it's almost a no brainer for anyone who is eligible for the procedure. LASIK today which is a multi billion dollar industry has been refined both in terms of quality of outcomes as well as the volume has brought down the price. It is now basically a mass market product available to most that want to get rid of their glasses or contact lenses. LASIK became so popular that after an initial boom in the 2000's the number of procedures actually dropped (everyone interested who was older already got it). With myopia now growing so significantly in prevalence the industry is now on a growth path again.

Another important area, like already mentioned are products that try to stop myopia from progressing and getting worse in the first place. One big reason why that is important is that high/severe myopia is dangerous on a different level than more mild cases. Your retina could detach and you have increased risk of a number of other eye problems as you grow older. Basically up to moderate myopia is quite risk free, after that it's getting worse complications. So the incentive to stop myopia should be there for parents, but as the figures show, it's not easy to stop. Also high myopia means that you are basically blind to objects further away (you can see contours but no details on objects a few meters away). So you are very dependent on your glasses, contact lenses or whatever you are using, it really turns into a real handicap. In my view, due to the increase in more severe/high myopia cases the investment opportunities from myopia grows a lot, as it is much more urgent and important for the person to do something about it.

Weifang study - High Myopia (> -6 D)

Weifang is a smallish Chinese city with a population of about 10 million. This is not the most affluent area where all parents are buying night tutoring to their kids, probably it is a decent average of what China in large looks like today. A huge study was done on basically all school children in Weifang, over 1 million children. The results are similar like the color full graphs shown above, but actually even worse:

High myopia (> −6.00 D) prevalence was 20.12% for high school students. As myopia progresses into the early 20s the figure for adults are therefor even higher, probably around 25-30% (my guess). That means in the future 25% of the Chinese adults have eye sight which is like the third picture above or worse and there are no signs that we are reversing this trend. Like the Covid study done in China mentioned earlier, these numbers of high myopia is unfortunately just getting worse.

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9358211/

Myopia as an investment

So what would you then guess I say is the investment case to make here? Well like I said I tried for 2.5 years to figure this out. Instead of jumping on the first or second good company I found I looked at different categories and held off (until now)

Companies that slow progression or produce glasses / lenses

First a looked at Cooper Vision part of (Cooper Companies ticker COO). A really good company who have come out with a good contact lense (MiSight) to slow down myopia progression in kids. Unfortunately this company is so huge, so even if MiSight product grows big, it's almost not going to move the needle in COO total sales and profit. Most of Cooper's profits is rather from regular contact lenses and a big surgical segment (related to fertility etc). But all in all, Cooper is a great company, they will benefit from more people needing help with their vision for sure. If it ever trades down 50% or even 35-40% I'm buying it straight away - but it's not the ideal way to get exposure to this mega-trend. There are also other lens companies like recently listed giant Alcon, twice the size of Cooper its the market leader globally on contact lenses. But neither here are they at the forefront of a solution to myopia (and especially high myopia) than just their existing range of contacts.

Eye surgery clinics

Another way would be to invest in eye-clinics, there are especially in China a few listed ones. A Hong Kong listed company is called C-MER (3309 HK) but the valuation is so lofty that it has never interested me, perhaps one day the market will give an opportunity here.

Producers of LASIK machines

So how about LASIK? The LASIK area has good growth and can restore eye sight for myopia. Yes this area has nice growth but competition is fierce, these machines although refined are by now old tech, there are many different companies producing the machines and selling machines. A bit like Cooper, these companies are not but, rather high quality more mature companies. One example here would be Carl Zeiss Meditec AG (AFX), again quality company, but valuation too high for me for such a mature company. There is also one big issue with LASIK, it's not really suitable for people with high myopia. LASIK stops being the treatment of choice somewhere around larger than -8 D, some clinics go further, but its no longer the gold standard past this point. It's around these levels of -7 to -9 D that, although some people can still do LASIK, many are not eligible because in their specific case there is not enough material to shave off with the laser to re-shape the eye back to good eyesight.

The latest choice for high myopia

There are good solutions in place for mild to moderate myopia already, basically up to moderate myopia are fine with just glasses (it's more beauty/convenience related to use LASIK). For high myopia and especially those that go several levels past the definition of high myopia as there are few choices. Basically the choice stands between wearing glasses or contact lenses, a surgery which removes your own lenses (unusual to do) or the product which is my investment case . We know from above mentioned studies more and more people are falling into the high myopia category, The product is meeting a quickly growing unmet need and that's why the product is growing so fast in China where high/severe myopia is so high. The company is called STAAR Surgical and their product is called EVO ICL which is the only existing Implantable Collamer Lenses (ICL) and it solves the problem if myopia all the way up to -15 D, and the patient can get perfect or near perfect vision back, with results just as good as with LASIK. In fact for patients in the -8D range, close to the maximum of where LASIK is recommended, the EVO ICL lenses produces better outcomes than LASIK. The best part of the procedure is that it is fully reversible, it does not remove anything from the eye, so a patient can fully reverse the whole procedure and do for example LASIK after, or just go back to wearing glasses. Not that many patients want to do that, given how extremely well the product seems to work. This is my latest investment case and I will go into much more detail in a full write-up later. But it is very important to understand this backdrop of how myopia is getting worse globally, it really is an epidemic and many companies like Cooper etc will have good growth from this. But I do believe the highest growth pocket will be for a small company like STAAR which has a unique product which meets a growing need which no other product in a satisfactory (and safe) way can do. Just running number like 25% of all Chinese in the future would have high myopia and be potential EVO ICL users and you understand that the potential is mind boggling.

I leave with a doctors comment here on EVO ICL:

In the future I will refer to this two part series (which took almost 2.5 years to finalize) when I talk about investments either within the spine or myopia space. As always, hope you enjoyed it as good food for thought and perhaps gives you confidence in the strong tailwind for companies in the eye-care industry.