RaySearch - The Post-Covid turnaround

Post is originally from my previous blog www.globalstockpicking.com

Disclaimer: This post is for general information purposes only and does not constitute investment advice. Always do your own due diligence.

Elevator pitch

Only independent software company in radiotherapy for cancer treatment with very strong product offering, never lost a customer.

Founder led company which spent more on software R&D than the current market cap of the company.

Although their product is good, a strong R&D push which reduced profits + previous aggressive accounting and now Covid-19 has hammered the stock from 260 to 45 SEK.

New CFO in place and CEO/CFO has promised focus on cost control (for the first time).

With a stronger software offering, hospitals are going back to business as usual, latest report confirmed early signs of turn-around.

RaySearch has 70% market share in proton therapy, which has a very strong outlook the coming ten years.

With very conservative estimates more than 60% upside and a weighted valuation pricing gives 85% upside.

Background

RaySearch is a Swedish medical technology company that develops software to improve cancer treatments. RaySearch software is today used by over 2,600 clinics in more than 65 countries. The company was founded in 2000 by Johan Löf as he was working on his PhD in radiation treatment. Johan is still the majority shareholder and CEO and has proudly stated that RaySearch has never lost a customer, that's a pretty strong statement. In the early days RaySearch delivered functionality to the leading treatment system vendor Philips. In 2003 RaySearch listed on the Stockholm exchange. RaySearch is developing highly complicated software in a very specialized field. The cancer treatment facilities are among the most complex areas in a hospital and requires both very advanced machines and software. Radiotherapy kills the cancer cells by various kind of high energy beams, like x-ray or protons. The core of RaySearch products and what Johan worked on already in his PhD is a more clever dosing of the dangerous radiotherapy. Basically "burn" away the cancer with higher precision, meaning minimizing damage to healthy tissue. After the early cooperation with Philips, RaySearch tied more and more partners to its development. Companies like IBA Dosimetry and Varian as well as certain large University hospitals worked together with RaySearch. Over the past two decades RaySearch grew from a small niche player with some smart algorithms into the only major stand-alone software company in this field. All this was done without any share dilution, RaySearch has funded all growth by being profitable from a very early stage. This R&D has coincidentally costed RaySearch just in line with the current Market Cap of the company (1.55bn SEK). Let's look at the history and the products RaySearch developed in greater detail (press read more).

History and software

A key to understand RaySearch and its products is to understand what is going on in the radiotherapy department of a hospital. The picture is a bit dated, taken from an old RaySearch annual report but its a good introduction for the ones that need it (click to enlarge).

RayStation (treatment planning)

From 2008 RaySearch decided to create its own stand alone treatment planning system (RayStation) and sell it directly to clinics. This was obviously a large step as previously RaySearch improved someone else's product offering, now they came in as a challenger with an alternative standalone software. Late 2010 RaySearch kicks off its sales in Europe/USA and in 2012 in China. In 2013-2014 the RayStation software gets more mature with new versions released, sales picked up at an impressive rate (around 30% YoY growth). With benefit of hindsight these really became the golden years for RaySearch, sales boom off a fairly small cost base.

RayCare (Information System)

Scroll forward to 2017 and RaySearch decides recycle a lot of these profits, taking their products to the next level. RaySearch establish a Machine Learning department, which now in present time start to bear fruit (more on that later). An even more important introduction was the new software, RayCare. RayCare is a so called Oncology Information System (OIS). In more simple terms this means an information system to file data about the patients (prescriptions, side effects, delivered dose and much more). This takes RaySearch further away from its niche of just providing a very specific system (RayStation). This system has the potential to be the cancer departments main tool used to track all activities related to the patient.

In 2018 the impressive growth levels slows somewhat but the company still grows a healthy 10-15% YoY. In 2018 Anderson Regional Cancer Center in USA becomes the first customer to order the RayCare platform. RaySearch continues during 2019 to expand its staff and prepares an even stronger sales push. Unfortunately that sales push barely gets off the ground as 2020 Covid halts all activity. Covid hampers sales opportunities with large hospitals which switches focus to Covid rather cancer care improvements. For the first time in over ten years RaySearch sales drops.

RayIntelligence (Big data analytics)

Even if sales suffer, the now larger development team continues to upgrade their software and launch new ones. In 2020 RayIntelligence is released, to understand it one can break it down into 3 products: Ray-Data, RayAnalytics and RayMachine. Ray-Data - extracting all data from everything that happens within RayStation and RayCare. Everything that is related to the treatment planning of the patient, all the diagnostic data, and from RayCare, everything that's been done to the patient in terms of workflow, administering of drugs, radiotherapy follow-up etc. All of this data is a big repository in Ray-Data. RayAnalytics - is a way to provides means to visualize the Ray-data, to see connections and look at population data. RayStation deals with 1 patient at a time, RayAnalytics looks at aggregates. RayMachine - based on all of that structured data one can create machine learning models that are used to drive machine learning algorithms within RayStation and RayCare. Basically to unleash the full power of both RayStation and RayCare.

Machine Learning (part of RayStation/RayCare)

Another example of ML that I found was what their new ML algorithms can do within RayStation: The deep learning contouring feature in RayStation uses machine learning models that have been trained and evaluated on previous clinical cases to create contours of the patient’s organs automatically and quickly. “We used deep learning to contour the first patient on May 26 and the treatment was performed on June 9. From taking 45-60 minutes per patient, the contouring now only takes 10-15 minutes, which means a huge time saving.” This press release is from June 2020. It's in my view impressive how RaySearch gone from starting a ML department in 2017 to three years later having product which improves processes so much for a client.

RayCommand

2021 also became a lost year from growth/profit perspective. Since RaySearch is an independent company their software has to work with different hardware, RayCommand was released early 2021 to bridge such differences and simplify treatment processes with different hardware.

That is a short summary of the history and also an overview of what RaySearch software does. What is clear from this history is that a lot has happened in the past 3 years. RaySearch basically goes from a one product software, RayStation, two having a suite of options. Both RayCare and RayIntelligence are highly ambitions software to launch and they never really got off the ground before Covid hit. We are now entering 2022 and seeing clear signs of a turn-around in terms of order backlog. The jury is still out how successful the new software will be, but its clear RaySearch has put considerable effort and money into developing these.

Market Outlook

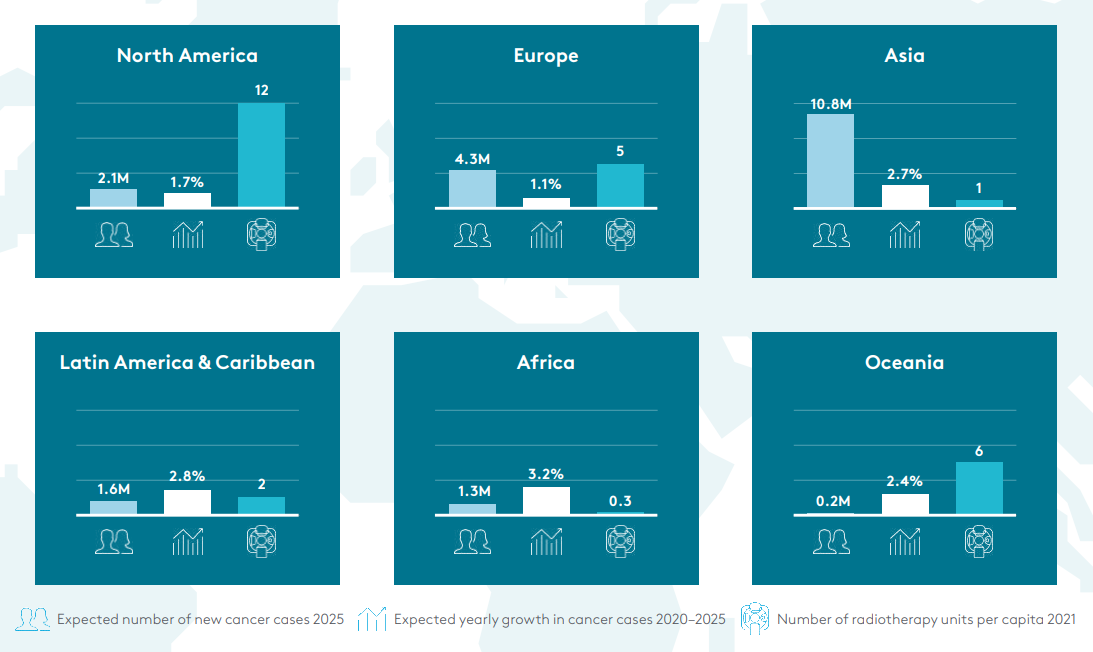

There is a lot of talk in the cancer industry that the coming years could be very bad cancer patient years. People have been holding off getting a check-up, due to Covid and hospitals have also been overwhelmed. Reports are already coming in from doctors that they see later stage cancers than they normally would, truly sad. There is a strong case that hospitals will have to quickly refocus on cancer care. Doing as much as possible with the resources available means that efficient software becomes key, here RaySearch for sure can play a part. Various studies will give different estimates of future growth of radiotherapy, ranging between 4-6% yearly CAGR. Much of that growth will come where the need is the largest, in Asia. As the below picture describes the "number of radiotherapy units per capita" various significantly between regions, with North America at 12, Europe at 5 and Asia at 1. So the case for increased usage of radiotherapy is very strong.

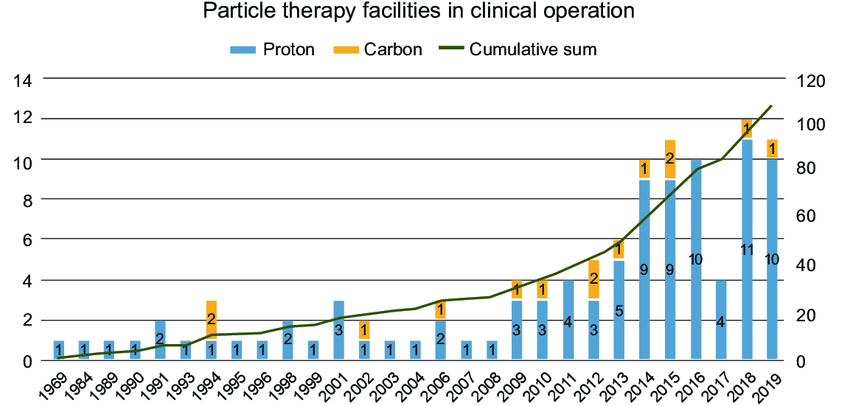

Source: Elekta Annual report A subset of this market proton therapy is set to grow at an even higher pace. Estimates seems less predictable but most are above 10% yearly CAGR, although I found one study that estimated it as low as 2%. If we look back historically we can see that growth has accelerated over the last few years. Overall the growth prospects for the industry looks to have good tailwinds. Why is proton therapy so interesting? Because RaySearch is the gold standard software in this niche.

Proton Therapy - the new gold standard

What USA does matter a lot for setting a standard of care, especially when we are talking about expensive new health tech. Healthcare professionals have for a long time agreed that proton therapy is superior (to x-ray) for some types of cancer. For example the most common male cancer in the prostate is a strong candidate for proton use. Even so the growth of proton therapy has been extremely slow. The reasons for these are numerous, for example even if the X-ray technology does not have the same potential, it has been refined to a higher degree than the proton therapy. A bit like an EV being superior to a Petrol Car on paper, but for a long time the EV tech was not mature enough (For the interest reader see this Debate). The tech side is changing rapidly though, partly thanks to RaySearch software and proton therapy seems to clearly be the future from a pure technical perspective. Proton systems are also more expensive, so although they are sometimes better cost is also weighed into the equation. This I see partly as the same issue as with EVs again, volume will drive down price. One important economical aspect of this has also been that insurance companies in the US have denied a lot of people to use proton therapy. Naturally a hospital wont invest in a super expensive proton system if their customers gets denied its usage by their insurance companies. This seems to have changed significantly over the past years, especially through this judging in 2019: Judge rips insurance company for 'immoral, barbaric' cancer denials. As the article states UnitedHealthcare the largest insurance provider in the US changed its policy in 2019 around proton therapy, so that hurdle is now cleared, proton therapy will be approved. It's very important that the US can lead the way for bringing down proton therapy cost, since the public healthcare systems in the rest of the world weighs in cost effectiveness for what they will purchase. With a lower price and a larger gap in outcomes between proton and photon therapy the public health systems will also shift.

Understanding the customers

RaySearch has a very impressive list of customers, including Princess Margaret Cancer Center, MD Anderson Multi-cancer Center, University of Washington Medical Center and Massachusetts General Hospital. The later one has decided to gradually replace all existing treatment planning systems and use RayStation alone. Obviously this is the dream situation for RaySearch and ultimately what the company wants to achieve with all customers. So far, this approach seems to work better at the bigger and more complex hospitals. My take on this is that the hardware is so extremely expensive, so for top of the line hospitals, if they can squeeze out a bit more performance out of these machines with better software, that is worth a lot.

Smaller centers are key to growth

Smaller centers with with perhaps only one or two simple linear accelerators (the more standard type of radiotherapy) is not in the same need of such a sophisticated platform as RaySearch offer. RaySearch has created a simplified pre-configured version of RayStation that they call RayPlan for the less sophisticated customers. RaySearch has admitted in the past that this is the area they would like to get better traction in sales. So far that has not gone according to plan but is a key factor for how much growth the company could see in the future. Johan in a recent conference call gave a very strong example of how their new suite of software could create a very strong sales pitch to smaller less sophisticated clinics. We have a collaboration with MD Anderson in Houston. So we'll take their treatment protocols and their entire workflows for all cancers, head and neck, breast, prostate, lung, et cetera. It will result in complete workflows that are viable options for both RayCare and RayStation. So a clinic in India can mimic the MD Anderson way of treating any cancer. It's so much information in such a protocol. It's exactly how you define the tumor, how you define the margins, which structures to include in the treatment plan. How much dose should be given to various areas? What was the maximum dose to other areas? And what's the quality assurance procedure, et cetera. All of that is embedded in a complete workflow. And this is extremely powerful, that we can spread the highest standards of care that are developed in these most advanced centers in the world, and they can be easily applied to a much smaller clinic with much less resources anywhere in the world. And RayCare, RayStation will be the vehicle of that and combined with RayIntelligence. I found this comment from Johan to be one of the things that made me the most bullish on RaySearch in the long term. For a small clinic in an Emerging Market to say they work with the same process flow as the worlds leading cancer clinics is a pretty strong selling point from the clinic towards its patients.

Particle/Proton therapy

Customers/hospitals have a number of hardware and software providers. Many hardware solutions are bundled with software from the same vendor, perhaps the hardware is great but the software could be better? RaySearch is trying to get a foothold at these hospitals and basically take over as much as possible on the software side. There are many different types of cancer treatments as explained one niche is called particle/proton therapy. RaySearch has a very strong foothold here, basically being the market standard software system. There are roughly 100 particle centers world-wide and RaySearch is selected at some 70 of these. Growth of particle therapy is hence good news for RaySearch who often wins these contracts and gets a foothold in more centers.

Press releases

Reading through RaySearch press releases one can get a deeper understanding of how large hospitals work and think. "Charles-Le Moyne hospital has been a RayStation®* customer since 2018. With the planned expansion, the cancer clinic will now fully replace their former treatment planning system with RayStation for all of their radiation oncology services, which today includes eight linear accelerators. Further, the clinic has added new and advanced technology to the order, including multi-criteria optimization, dose tracking, adaptive planning and TomoTherapy planning." "Carbon ion therapy is a highly advanced radiation therapy technique that can be effective for complex tumors which are difficult to treat with conventional methods. The market for carbon ion therapy is gaining momentum in China with several facilities either under construction, or in a planning phase. Lanzhou Ion Therapy Co, LTD (LANITH), located in the city of Lanzhou, specializes in the development and installation of medical devices using carbon ions and other heavy ions. LANITH has now chosen RayStation to ensure maximum dose precision and workflow efficiency" "RaySearch Laboratories AB (publ) announces that La Clinique Générale-Beaulieu, a part of Swiss Medical Network in Switzerland, is the first center in the world to treat a patient using the Accuray Radixact® radiation treatment delivery system with RaySearch treatment planning system RayStation®* and oncology information system RayCare®. Johan Löf, Founder and CEO, RaySearch, says: “We are very pleased to hear that the first treatment with Radixact and RayCare has been successfully carried out at this world-class center. It is an important proof of concept that RayCare can be used as the sole oncology information system together with Accuray machines." "National Cancer Centre Singapore (NCCS) has placed an order for RayStation®* as the treatment planning system for its new proton therapy center currently under construction and scheduled for completion by 2022. The Goh Cheng Liang Proton Therapy Centre at NCCS will be equipped with the state-of-the-art PROBEAT treatment delivery system from Hitachi. The setup will include four treatment gantries capable of 360° rotation and a fixed-beam room. Hitachi’s treatment delivery system includes dose driven continuous scanning (DDCS) functionality –an innovative technique aimed at improving proton dose delivery accuracy. RayStation is currently the only treatment planning system to support DDCS."

The founder/CEO

Johan is a highly intelligent physicist who has proven he does not only have the engineering smarts but also the business acumen to build a company. Johan's mom passed away in lung cancer when Johan was a young boy. Reading up on Johan's and RaySearch's achievements, its clear that improving survival rates from cancer is a real passion project for Johan. He is a highly involved CEO, looking at Glassdoor comments he seems so highly involved that the most common negative comment mentioned is how top-down driven the decision making is in the company. At the same time he seems to have created a company with a very family like culture and overall Glassdoor scores are quite good. Johan built the company from scratch and I have a lot of respect for CEOs who 20 years later still are at the helm, involved in details and improving their product. Johan describes in interviews how he often visit the cancer clinics waiting rooms when he travels the world. There he gets inspiration and ideas how to better develop his software to help cancer patients. Maybe this was one of the reasons for RaySearch to take the big step of developing their own Oncology Information system, RayCare. Perhaps this passion for growing RaySearch into a better/bigger company has also created the situation the company is in currently (loss making and looking at cost savings), more on this later.

Compensation and shareholding

Compensation as in almost all Swedish companies is very modest, Johan's bonus is capped at 1 year salary, with a salary of roughly ½ million USD. Johan holds about 19% of the overall share capital and with a dual voting share structure he holds some 57% of the votes, his old time professor holds some 10% of the votes as well. It's obviously a big positive to see Johan have such a substantial holding in the company. The dual voting structure is unfortunate though in my view. With all the IP the company has, its strong market position and current low valuation, there is a clear case for someone bidding on the company. But with this structure in place, it's up to Johan if he wants to sell or not. Johan has been selling some of his shares lately. He has done this a few times in the past, always stating personal reasons. I don't really see any issue with this, he still has such a significant holding. With almost all of his wealth (presumably) tied up in the company its natural to diversify at least a little bit. I'm a bit curious with the timing though since the share has been under a lot of pressure lately and last year end he sells his shares at a multi-year low. Hopefully it really was some urgent expenses that he had (I guess he would have sold more if he really is giving up on the company).

The competition

RaySearch has three competitors for RayStation:

Philips' Pinnacle

Varian's Eclipse (now part of Siemens Health)

Elekta's Monaco

The later two are packing their software with their hardware. Basically RayStation has to be significantly better than their included software for a hospital to consider changing from something that comes with the hardware. RaySearch has had success to convert centers with both photon and proton therapy to RayStation, as they are the best choice on the proton therapy side. It's hard for me as a layman to judge which software is better at what. What I can see is that for example Philips Pinnacle system does not seem to inhouse be able to create that ML contouring as earlier described. They partnered with an external firm to bring that functionality into their software (not sure if its even a launched product for them yet). Since the other two only produce software for their own hardware, the risk here lies with that these hardware players take over the whole market. It would be better for RaySearch if the market got more fragmented with other players taking market share in terms of hardware sales (for example Accuray). Varian and Elekta are the two giants in the industry though. RayStation is today installed in over 700 clinics, which is roughly 10% of the worlds clinics. The fact that RayStation has been sold in so many clinics says something to me about the quality of the product compared to the products Varian and Elekta include with their hardware. In some sense this makes sense, RaySearch pioneered the industry and lives and dies with the quality of its software. Elekta and Varian are foremost researching and producing the hardware and software is important too but not as important as the hardware. On the RayCare side there are two competitors:

Varian's ARIA

Elekta's MOSAIQ

Given how new RayCare is, it's hard to judge in what kind of shape RaySearch is to get clinics to switch from ARIA/MOSAIQ to RayCare. What seems clear at least is that its harder for RaySearch to win such contracts when Varian and/or Elekta is not co-operating with RaySearch. So far, ironically enough the company who has refused any coop with RaySearch is the Swedish company Elekta. Wheras for Varian, RaySearch in 2020 signed and interoperability agreement that will allow the RayCare oncology information system to connect to Varian TrueBeam linear accelerators. See press release: link. This agreement basically enables the use of RayCare for clinics who use Varian's TrueBeam accelerators, it's a big step since the TrueBeam accelerators are one of the most common ones in the market. Varian has been dragging their feet in the validation steps for interoperability, in the latest conference call Johan commented that it will be done for sure later this year. If this somehow would fall through (maybe because Siemens now acquired Varian) that would be a pretty big negative for RaySearch. That Varian are dragging their feet to finalize what they agreed does not sounds great but I'm still cautiously optimistic given Johan's comment. There are only some 20 clinics worldwide that so far switched to RayCare, a very small number compared to RayStation. There is some risk here if the Varian deal falls through.

The partnerships

RaySearch has many partnerships, here are four of the main ones mentioned.

IBA RaySearch has a very strong relationship with Belgium both with IBA and the Iridium Network. IBA is listed on Brussels exchange with a MCAP of 500m EUR. In particular these press releases shows how they work together with selected customers and basically build the next generation of their software together. In this case the RayCare platform: Iridium Network invests in RayCare to become their primary oncology information system. And here with IBA for proton therapy: RaySearch and IBA expand their partnership in proton therapy. Mevion Medical Systems A privately held company which is a market leader in compact proton therapy systems. This is a pretty well funded company and from valuation rounds the estimated valuation of Mevion seems to close to 1bn USD. RaySearch and Mevion have collaborates since 2014 and new functionality on the hardwire side is developed together with RaySearch software. This is one of the clear partners for RaySearch to ride the proton therapy boom. Accuray Accuray a 340m USD MCAP company (still twice RaySearch's current MCAP) makes radiotherapy hardware and has not really been a winner in this space. The stock is trading close to all time lows and sales have been flat in the past 10 years. Although Accuray has their own treatment planning software, the co-operation with RaySearch seems very tight and RaySearch supports their whole platform of hardware products. Even at trade shows Accuray and RaySearch do joint previews of their products. Strong sales of Accuray hardware would clearly benefit RaySearch.

United Imaging Healthcare (China)

Founded in 2011, UIH has developed the world’s first medical linear accelerator with fully integrated diagnostic-quality CT imaging to support adaptive therapy planning. RaySearch will adapt RayStation and RayCare to UIH’s CT and standard linacs. They will be the first conventional linacs to be integrated with RayCare.

Financials

As previously mentioned RaySearch has an impressive track-record of growing in a profitable way. The Covid situation has clearly both stopped both the nice revenue growth and profitability. A rebound seems very likely as the world is opening up.

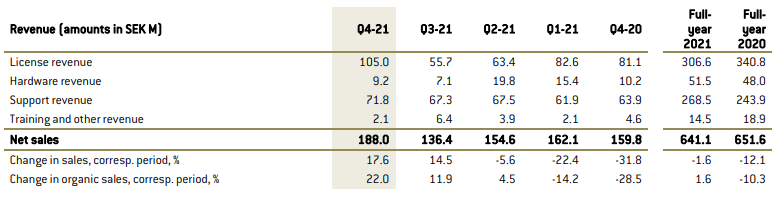

Revenue is split in the below categories. The past two quarters are showing early signs of a turn-around. It's also important to note that as RaySearch install base grows larger, the more sticky support revenue is growing to a very decent size. The market should trade this revenue at a higher multiple than volatile licensing revenue. Hardware is related to physical computers etc which are delivered with the RayStation installation.

Unsurprisingly the distribution of sales is nicely spread across the world, RaySearch is a true global business.

Explaining the share price drop

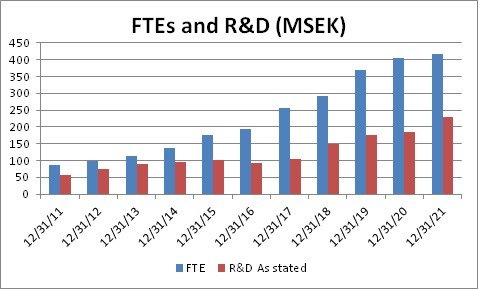

As you have seen the share price performance has been awful over the past years. I think its worthwhile spending a bit of time asking why is that? First of all obviously profitability has dropped significantly over the past years. The big picture for that is that RaySearch has decided to increase (development/R&D) cost quicker than they had profits coming in the door. Given that RaySearch is a software company that costs basically mostly comes in the form of headcount. Below you can see that FTE and R&D basically goes hand in hand and increased quickly from 2015 onwards.

This disregard from growing profitably is pretty much in-line with the growth mantra the stock markets have been rewarding (until recently). Don't show us profits, just maximize growth and RaySearch seems to have joined in on that. The next item that would explain the weak stock performance would be related accounting. RaySearch has got criticism for its accounting practices. We need to figure out what is going on there.

Accounting

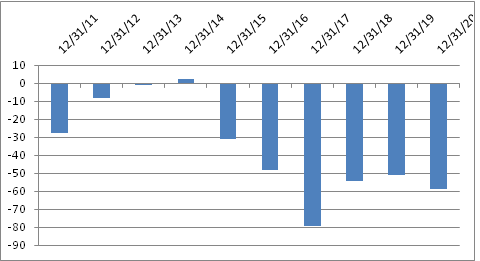

I usually don't dive into accounting details in my write-ups. If I see red flags I usually avoid the companies and there won't be any write-up. Most cases I write up the accounting is pretty straight forward. In RaySearch case there is a history of the company getting criticized for it's accounting treatment, so we need dig a bit deeper than usual here. The criticism is that the cash that the company generates is much smaller than the net profits, see comparison below. This has been true and relates mainly to two accounting treatments, more on that below. To make it even more complicated the accounting standards where changed in 2018, when IFRS15 was introduced. This reduced the revenue that RaySearch could recognize in 2018 (a good thing if you want RaySearch to be more conservative). Below is an important graph where I defined what I see as the true cash flow generations, removing any new debt issuances or repayments.

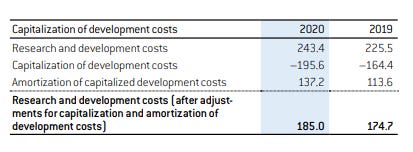

As you can see RaySearch during its big growth years, showed very nice growth in Net Income, whereas the company generated very little cash. This large timing difference is a head scratcher and could be one of the reasons why RaySearch is trading at such a low valuation today. People got cold feet from the cash never showing up and was one of the reasons for the weak stock performance. As Net Income dropped this reversed in 2019/2020. Let's look at how this happened: R&D costs are capitalized and then amortized

The first row present the actual development costs (in cash terms), whereas the last row is what is deducted from revenue to end up with a Net Income figure. This explains the majority part of the gap between Net Income and cash generation. Below is a graph of the difference of the first and last row of the table:

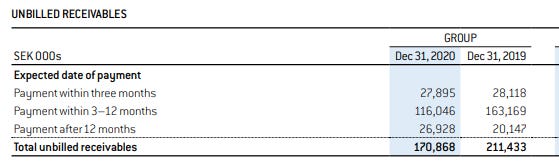

For 2011 - 2022 this summarizes to 355m SEK in R&D expenses that are capitalized, which has "inflated" Net Income vs actual cash flows. But this is not all that goes on unfortunately. In my view this is fairly straight forward. The next effect is more "hairy" Recognition of revenue vs receiving the cash In turns out hospitals are both great and awful customers. Great because they are secure credits who rarely default on their obligations. Awful because the payment terms are sometimes very very long and the hospitals are even sometimes late to pay. This means that since RaySearch recognizes the income when the software starts to be used but does not receive an actual cash payment from the hospital, some of that net income is therefore building up as accounts receivables. Given that the capital cost of software is free (no physical object costing money) the negative aspects of having to wait to get paid are in my view not so bad. As long as the companies actually do pay, its basically shifting all payments in time. The result though for a growing business with growing profits, means you are always one step behind in your actual cash-flow (if you are early to recognize the revenue). RaySearch has in my view been to quick to recognize revenue. Perhaps IFRS15 in some way forces RaySearch hand in this, but I do believe there is still a choice to define the performance obligations differently, which would delay the recognition of revenue. The receivables are split into billed and unbilled receivables in the accounting notes. Billed receivables I don't really have a problem with, it's pretty standard, you sell a software and send the bill, with some payment terms on the bill (like 90 days). Unbilled is where it gets a bit murky in my view. This is where you recognize the revenue but the bill has not even been sent yet, so obviously payment terms will be longer here. Some of the reasons for this (as I understand it) is that some new customer need a long time to get fully up and running on the new software. So they won't pay before this is met, and this could be up to a year later + the bill terms after that. The receivables historically have been split like 50/50 between billed and unbilled.

Note the word expected date of payment above, its unbilled so this is some type of best estimate. I would have preferred that RaySearch would have just not recognized this revenue at all, until its billed. But then RaySearch would have been much later in showing it's very significant growth, perhaps shifting the whole Revenue and Income distribution 1 year later. Also looking at competitors like Varian, they also have unbilled revenue, so it seems to be the market praxis. As you can see the unbilled amount decreases 2020 vs 2019, with some 41m. Also the billed amount decreases with 38m SEK. This explains the strong cash-flow in 2020 where these receivables are released as they land as cash on RaySearch account. Actual credit loss levels have been fairly low, although 2020 did see a larger jump (-12m SEK in actual losses), so the recognized revenue should show up as cash when the receivables are released (minus higher than expected credit loss levels).

Summary of accounting deep dive

Two effects have in the past been hindering cash flow although RaySearch reported strong Net Income growth:

To capitalize more R&D cost than you amortize, which is indirectly is an effect of R&D spend increasing.

Revenue recognition with complex payment terms for delivering software and continuous support of that support. As with R&D this has overstated Net Income vs cash flow due to increasing sales.

To summarize this is not great accounting practices, but is not a show stopper for me. All software companies have some type of model for revenue recognition, especially in the new SaaS world it get complicated. RaySearch model has perhaps been a bit aggressive, but now cash is coming in. As my picture above shows 2019 and 2020 had higher cash generation than Net Income. A lot of people seems to have sold the stock due to poor cash generation and now forgot about the stock when the cash generation is strong (due to Covid issues taking focus instead). Now the CFO has stated they will not expand R&D further either from this level, so Net Income and Cash flow should be more aligned going forward with a more stable R&D spend base. And even if it wasn't stable I would be OK with this effect, as long as I understand it. What matters in the end is that the product sells and customers pay.

Looking ahead

It's clear that RaySearch has ambitions goals to go further on the software side than any competitor has. A statement I found on long term plans: “Ultimately the goal is co-planning of radiotherapy, medical oncology and surgery within the same software platform". RaySearch has in the past years doubled the number of staff, significantly increased R&D spend (significantly sacrificing profitability). Just when this development push was supposed to bear fruit, Covid happened. It doesn't matter how good software you developed when the hospitals are busy with something else. Obviously the competition has not been standing still either but relatively they have not more than doubled their R&D budgets like RaySearch has. The most likely outcome in my view is an initial sales bump from hospitals catching up with spending that had to wait for the past 2 years. After that the "cancer debt" will continue to take its toll which to me seems like a strong argument for hospitals to continue to invest heavily in this field for the coming 3-4 years. In the very latest report we could see the early signs of this bump.

Early signs of turnaround

With the install base being larger, although order intake is far from record levels, the support backlog is large enough to bring total backlog to all time highs. The markets rewarded RaySearch which a +15% stock price increase when this report was released but due to the generally weak market the stock is now trading below that initial price bump. Waiting for the turn-around to show up in the figures you will usually have to pay a higher price, but in this case it seems to me you can buy at rock bottom although the turnaround is already here. Another large growth area is something we did not touch upon in this write-up. That is that RayStation now since recently supports brachytherapy planning. A lot of radiotherapy clinics also offers this type of treatments. As is the case with proton therapy, its attractive for a client who already uses RayStation to get one common system for all treatments and the wider RaySearch offering is the higher the likelihood is for that jump. With all in this write-up in mind, lets move to valuation.

Valuation

All my scenarios are starting with that the first years revenue will see a recovery from the Covid depressed levels. So the starting point is a slight increase on the 2019 revenue levels. After that I draw the usual three scenarios.

The bear scenario is in my view unlikely, it assumes basically a total failure in increasing future sales. This would mean all the R&D and doubling in staff would have been partly lost investments (or investments made to just keep up with competition). The base scenario takes an conservative turn-around approach. Sales will grow but at a moderate rate, more importantly Operating Margins will only slowly recover and never fully recover to levels seen in 2016-2017. The bull scenario sees 4-5 years of very strong sales growth which later slows than in YoY growth terms, more towards industry predicted growth levels. The Operating margin also recovers much quicker and reaches higher levels as the company reaches scale benefits in its operations. To this I use a 10% discount rate

Probability Target Price Bear 15% 27.6 Base 45% 75.2 Bull 40% 117.0 Weighted TP: 84.7

This gives me a weighted target price of 85 SEK, which is roughly 85% upside to the latest traded price. I have taken a position in RaySearch over the past months with an average buying price in line with todays price. A lot of work went into this research (1.5 month) and I learned a lot myself about radiotherapy. For the ones that made it through this whole long read-up I hope you enjoyed it too! As always comments are more than welcome.

Key Metrics to ongoingly follow

Revenue growth back on track

Cost control and return to profitability (in actual cash flow)

No increase in credit losses