Disclaimer: Healthy Stock Picks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do hold a position in Agfa Gevaert when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

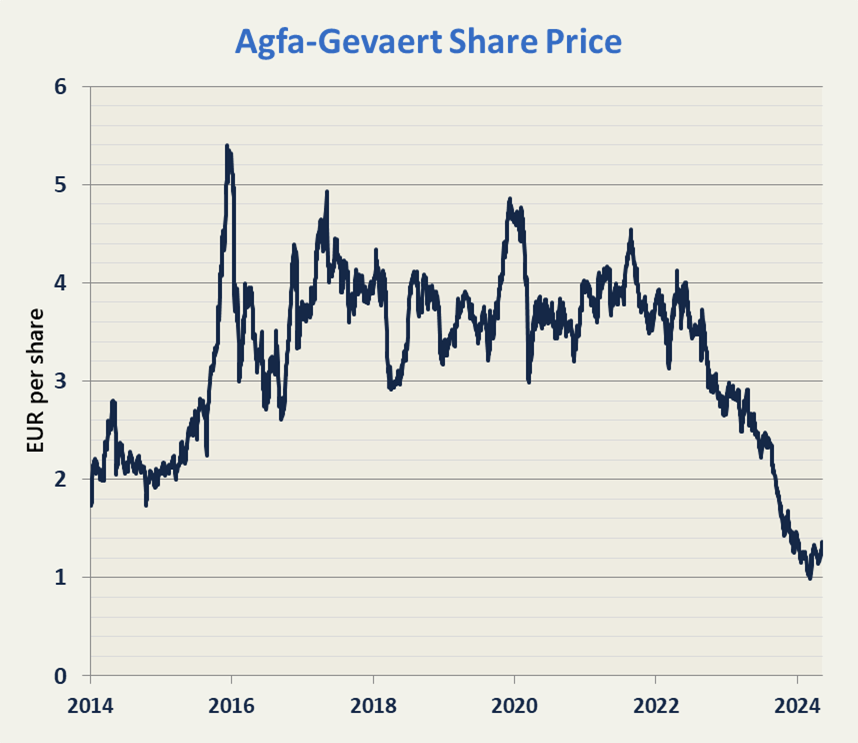

Agfa Gevaert is a 150 year old Belgian conglomerate which has been world leading in film and photo related business. Today it’s a micro cap valued at €210m but you get brand recognition and reach like a mid/large cap.

Active Ownership Capital (a friendly activist) took 7.5% of shares and a board seat in 2018 and has since increased its stake to 19%. It’s clear they push to bit by bit dismantle the “old empire building”, installing new management & creating a smaller leaner company.

Agfa has struggled with too many legacy businesses and a large pension burden. By selling down assets and paying off chunks of the pension debt the company is emerging as “investable” again. But market is focusing on a deteriorating Radiology business.

Cash flow stability can be found in medical imaging software and long term upside in green hydrogen membrane production called Zirfon. Zirfon has been pointed out by independent parties as market leading. ThyssenKrupp a leader in installing hydrogen plants has signed to install Zirfon in their plants.

Stock price and much of fundamental history looks awful. But with an activist investor, new management team who divested underperforming assets and kept some market leading ones, the stock has discounted too much negatives and none of the positives.

Agfa-Gevaert is as said an old conglomerate which acquired and spun off various entities over its very long existence. Today the company is mainly active in Healthcare and Industrial Printing + Chemicals. The majority of the cash generation comes from the Healthcare side and hence I found it worthy of being covered by Healthy Stock Picks.

The Healthcare business is split into two part:

Image management software, Agfa is a decently sized player in this fragmented market.

Radiology, X-ray machines of different types and the consumables that comes with it, for example printed X-ray films.

The Printing + Chemicals business can also be further split:

Printing solutions are industrial. This means huge machines to print for example signs, displays and even fabrics. Within printing hides many niche businesses, for example phototooling (a step in creating circuit boards), where Agfa is global market leader.

Chemicals is for example the after-sales ink to printers but also a new interesting business in Green Hydrogen production.

A very important factor, in this historically troubled company, is the activist investor who has been involved for the past 5 years and is pushing necessary change.

The next quarterly report is already out tomorrow, which should be exciting (as the previous quarterly was some early signs of turn-around)

Overall there is a lot to unpack in this company, which also means there could be quite a lot of value to find, if one looks closely enough. So we will look closely in the slide deck attached below. I hope you enjoy the idea!